The NFT Art Market and the Changing Image

When I first thought of GOLD

as a dynamic blockchain art series, my idea was that it could be a series of composable,

modular artworks. Any collector would be able to take apart all the individual elements

in an artwork and trade them individually, swap them for other compositional elements

and so on.

What I liked about this idea was the cold market logic. Any of my artworks could be torn apart and reassembled like commodities by a collector depending on their intent or financial ambition. NFTs are driving the hyper-financialisation of art and it seemed a good way to illustrate this. Ultimately I realised hardly any collectors would actually participate in this, so I decided to create something simpler, with less effort required.

As it exists today, the GOLD series listens to its collection’s own market activity, then changes visually in real-time on that basis. Collectors do what they normally do – buy, sell or hold onto the artworks – and the GOLD pieces will respond to the collector’s actions. The series is simply a reflection of existing behaviour. It doesn’t reinvent the wheel, it ‘reveals the wheel’. The only conditional element is that collectors are incentivised to hold their pieces for long periods of time.

The idea of reflecting back to collectors their own behaviour is an attractive one, partly because it gives me the opportunity to trigger some of my buyers. Because they don’t necessarily want it to be obvious when they buy or sell. Traders don’t want you to know if they paid a royalty or not. Flippers don’t want you to know they flipped. But GOLD makes a point of showing all of this behaviour through the artworks, as it happens.

I didn’t realise until GOLD secondary market trading began, how triggering it would be for me. Particularly the issue around secondary market royalties, which I made optional and many traders (and bots) took advantage of by not paying. I put this down to experience. GOLD as a collection exists in part to create these kinds of experiences amongst the people engaged with it. GOLD is an art series where the relational aspect has a meaning. That meaning is sometimes felt palpably by the people involved.

The dynamic transformations seen as a result of market activity in GOLD aren’t just pictorial reflections of technological gears in motion, they visualise behaviour of actors in the market. They reflect the idea of a digital market for art, it’s existence and implications. Bringing market actions from the background into the foreground through dynamically-changing imagery was the intent. The imagery isn’t just there to show you ‘what happened’, but to add visual, contextual depth to the landscape.

Image is important. When sales occur and a royalty is paid, pairs of open hands appear over the composition of every piece in the collection simultaneously. When a royalty isn’t paid, multiple concentric rings emerge. When an artwork is listed (approved for sale) it causes halo rings to intersect in the foreground of the artworks. These images don’t have an instant or literal pictorial logic. They draw attention to the action taking place in the market in a way that opens the event up to a viewer.

I took this approach with all the imagery used in the GOLD series. I created hundreds of images, which are thrown together in different ways in each unique artwork according to live market conditions and code. Some of the imagery is iconographic, some more abstract, but each one is selected by me because of its potential to create a space to perceive what is happening. Looking at any of these artworks in relation to their market opens up that contextual space. I use symbols and signifiers, also abstract forms, that suggest ideas, spaces or things without trying to reduce down to a narrative.

Many of the GOLD artworks contain imagery familiar from financial markets and charting interfaces. Mathematical symbols, curves and candlesticks are common throughout the series - the market is the art. But these elements are there as part of more complex compositions - changing landscapes where different vignettes or arrangements can appear and disappear at any moment. The associations between the different image-symbols are fluid because the compositions are constantly changing, opening up new potential views.

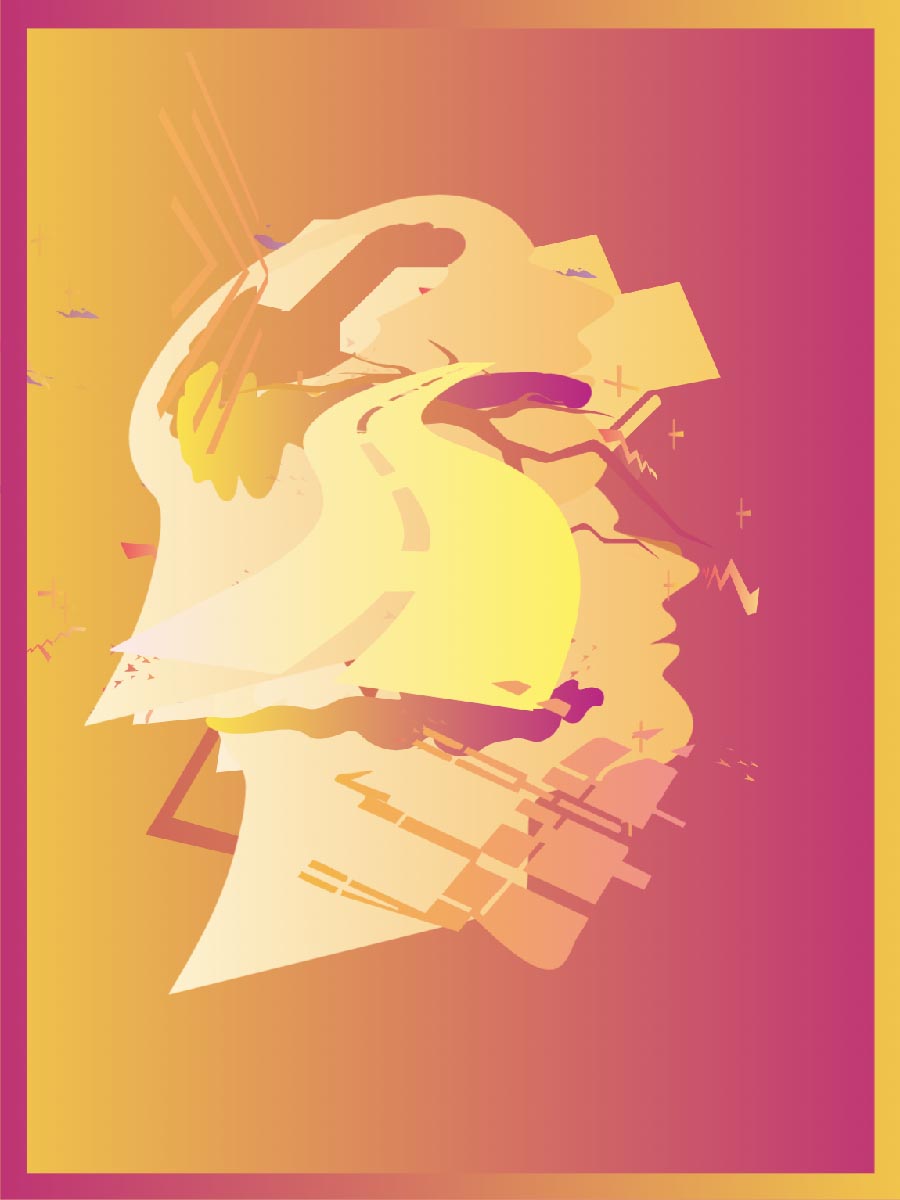

GOLD compositions can be read as a kind of ‘market structure’, with dominant and subordinate elements together. They can also often look like landscapes or busy urban networks. Human elements appear in some pieces. It was important to me to bring together shapes and forms that were familiar from life, sometimes also from other genres of art. Once composed together they begin to resemble ‘artworks’ and so can be read as such. They all have neat frames around them to complete the effect of marking them as objects of artistic consideration.

From representational to abstract and pop elements of various kinds, the picture parts are thrown together according to the on-chain NFT market for GOLD. This is the idea I started with, to make a collection where the art itself is determined and controlled by market behaviour. There’s an irony in making a collection this way. I give up some control over the artworks, but by doing so I get to define the context through which the market for my art is presented back to the viewer.

Colour is important. Each GOLD piece features some variation on a sunrise or sunset colour scheme, with the colour gradient often splitting the composition into two halves. This can give the effect of sunlight shading one side of a scene. Sometimes the bifurcated colours merge and objects can temporarily disappear. The colours are mostly bright and optimistic, reflecting the hyper-positive aspirations some market participants display.

Optimistic binary colour schemes are complimented by neat geometries, curves and the occasional cosmic form. GOLD insinuates itself into the seam of generative art and its endless variations of mathematically-generated beauty. Particularly the trend for art designed to meet the visual expectations of the NFT market. But there are also strange and distressed images to be found in GOLD. The flatness of the images can give a detached feeling at times. There are many layers in each GOLD piece which sometimes clash rather than complement each other.

Whatever the iconography displayed in a specific GOLD piece at a given time, one thing they have in common is a continuous impermanence. The state when you open a GOLD piece – any scenic or compositional logic – is guaranteed to disappear in time and be replaced with a new and different arrangement. This is the nature of market-determined art and of dynamically-changing digital art. The aesthetics of impermanence in dynamically responsive art deserves its own essay.

Impermanence is the normal situation for many of us who live increasing portions of our lives in front of screens. The flow of new information is constant. The replacement of the present moment with the moment yet to come is inevitable. In many ways, this is how markets operate too. A future moment in time is so strongly anticipated – given such great importance – that it supercedes the present moment. This is how we live our lives much of the time, so should art be any different?

Art can of course be very useful for magnifying the present moment. Reflecting on the present moment and how networks such as markets affect our perception of it is one way to cast light on the situation we’re in. More about GOLD

What I liked about this idea was the cold market logic. Any of my artworks could be torn apart and reassembled like commodities by a collector depending on their intent or financial ambition. NFTs are driving the hyper-financialisation of art and it seemed a good way to illustrate this. Ultimately I realised hardly any collectors would actually participate in this, so I decided to create something simpler, with less effort required.

As it exists today, the GOLD series listens to its collection’s own market activity, then changes visually in real-time on that basis. Collectors do what they normally do – buy, sell or hold onto the artworks – and the GOLD pieces will respond to the collector’s actions. The series is simply a reflection of existing behaviour. It doesn’t reinvent the wheel, it ‘reveals the wheel’. The only conditional element is that collectors are incentivised to hold their pieces for long periods of time.

The idea of reflecting back to collectors their own behaviour is an attractive one, partly because it gives me the opportunity to trigger some of my buyers. Because they don’t necessarily want it to be obvious when they buy or sell. Traders don’t want you to know if they paid a royalty or not. Flippers don’t want you to know they flipped. But GOLD makes a point of showing all of this behaviour through the artworks, as it happens.

I didn’t realise until GOLD secondary market trading began, how triggering it would be for me. Particularly the issue around secondary market royalties, which I made optional and many traders (and bots) took advantage of by not paying. I put this down to experience. GOLD as a collection exists in part to create these kinds of experiences amongst the people engaged with it. GOLD is an art series where the relational aspect has a meaning. That meaning is sometimes felt palpably by the people involved.

The dynamic transformations seen as a result of market activity in GOLD aren’t just pictorial reflections of technological gears in motion, they visualise behaviour of actors in the market. They reflect the idea of a digital market for art, it’s existence and implications. Bringing market actions from the background into the foreground through dynamically-changing imagery was the intent. The imagery isn’t just there to show you ‘what happened’, but to add visual, contextual depth to the landscape.

Image is important. When sales occur and a royalty is paid, pairs of open hands appear over the composition of every piece in the collection simultaneously. When a royalty isn’t paid, multiple concentric rings emerge. When an artwork is listed (approved for sale) it causes halo rings to intersect in the foreground of the artworks. These images don’t have an instant or literal pictorial logic. They draw attention to the action taking place in the market in a way that opens the event up to a viewer.

I took this approach with all the imagery used in the GOLD series. I created hundreds of images, which are thrown together in different ways in each unique artwork according to live market conditions and code. Some of the imagery is iconographic, some more abstract, but each one is selected by me because of its potential to create a space to perceive what is happening. Looking at any of these artworks in relation to their market opens up that contextual space. I use symbols and signifiers, also abstract forms, that suggest ideas, spaces or things without trying to reduce down to a narrative.

Many of the GOLD artworks contain imagery familiar from financial markets and charting interfaces. Mathematical symbols, curves and candlesticks are common throughout the series - the market is the art. But these elements are there as part of more complex compositions - changing landscapes where different vignettes or arrangements can appear and disappear at any moment. The associations between the different image-symbols are fluid because the compositions are constantly changing, opening up new potential views.

GOLD compositions can be read as a kind of ‘market structure’, with dominant and subordinate elements together. They can also often look like landscapes or busy urban networks. Human elements appear in some pieces. It was important to me to bring together shapes and forms that were familiar from life, sometimes also from other genres of art. Once composed together they begin to resemble ‘artworks’ and so can be read as such. They all have neat frames around them to complete the effect of marking them as objects of artistic consideration.

From representational to abstract and pop elements of various kinds, the picture parts are thrown together according to the on-chain NFT market for GOLD. This is the idea I started with, to make a collection where the art itself is determined and controlled by market behaviour. There’s an irony in making a collection this way. I give up some control over the artworks, but by doing so I get to define the context through which the market for my art is presented back to the viewer.

Colour is important. Each GOLD piece features some variation on a sunrise or sunset colour scheme, with the colour gradient often splitting the composition into two halves. This can give the effect of sunlight shading one side of a scene. Sometimes the bifurcated colours merge and objects can temporarily disappear. The colours are mostly bright and optimistic, reflecting the hyper-positive aspirations some market participants display.

Optimistic binary colour schemes are complimented by neat geometries, curves and the occasional cosmic form. GOLD insinuates itself into the seam of generative art and its endless variations of mathematically-generated beauty. Particularly the trend for art designed to meet the visual expectations of the NFT market. But there are also strange and distressed images to be found in GOLD. The flatness of the images can give a detached feeling at times. There are many layers in each GOLD piece which sometimes clash rather than complement each other.

Whatever the iconography displayed in a specific GOLD piece at a given time, one thing they have in common is a continuous impermanence. The state when you open a GOLD piece – any scenic or compositional logic – is guaranteed to disappear in time and be replaced with a new and different arrangement. This is the nature of market-determined art and of dynamically-changing digital art. The aesthetics of impermanence in dynamically responsive art deserves its own essay.

Impermanence is the normal situation for many of us who live increasing portions of our lives in front of screens. The flow of new information is constant. The replacement of the present moment with the moment yet to come is inevitable. In many ways, this is how markets operate too. A future moment in time is so strongly anticipated – given such great importance – that it supercedes the present moment. This is how we live our lives much of the time, so should art be any different?

Art can of course be very useful for magnifying the present moment. Reflecting on the present moment and how networks such as markets affect our perception of it is one way to cast light on the situation we’re in. More about GOLD